Challenge Objectives and Rules

To ensure that traders possess the ability to achieve long-term and consistent profitability, and to meet institutional fund management standards, SynergyTrader has established a strict and transparent set of risk management rules.

These rules not only protect traders from extreme market volatility but also provide investors with a clear risk control framework, ensuring the sustainability of the trading ecosystem.

Challenge Procedures

Synergy Trader is driven by the core values of Professionalism, Excellence, and Growth, and is committed to building a world-class incubation system for top traders. We are not just a trader selection platform — we are an elite development system that connects talent with global capital markets.

Synergy Challenge

The Synergy Challenge is designed to educate traders and guide them in developing disciplined trading habits. Traders demonstrate their skills and experience by following our trading objectives, which are based on key risk management rules. Upon successfully completing the Synergy Challenge, traders advance to the Verification Phase.

Synergy Verification

After passing the Synergy Challenge, traders advance to the Verification Phase. In this stage, the trading objectives are simplified — the profit target is reduced by half, while the maximum drawdown rule remains unchanged. Upon successfully completing the Verification Phase, traders will receive a Synergy simulated account.

- Upon successful completion, participants will receive the Synergy Trader Certificate.

- Receive an exclusive invitation to become a contracted Synergy Trader.

Synergy Trader

Participants demonstrate their skills and experience by following our trading objectives based on key risk management rules.

- Simulated Funds: USD 200,000

- Up to 80% simulated profit sharing

- Performance coaching

- Promotions

- Trading Tools and Other Services

Honor System

The Path to Excellence

Through the Synergy Promotion System, break through personal account limits.

Step into the core of the capital markets and embark on a new chapter as a professional trader.

Project Summit

Traders who pass the Synergy Trader exam will enter a world-class global incubation system. Through the Summit Program, they will enjoy high profit-sharing, transparently increased trading capital, industry recognition, and integration into the core of the capital markets. We have established exclusive reward mechanisms to help traders reach the pinnacle in a fair and transparent environment, achieve sustained profitability, and unlock greater benefits and capital support!

Capital Growth Program

The Link below presents a typical case:

The client successfully passed the evaluation process, obtaining a Synergy simulated account with a maximum allocation of USD 200,000, and met the criteria for the scaling program.

The growth trend of the account balance and risk parameters is as follows:

Why Choose Us

Experience efficient trading with us.

Synergy Trader

A symbol of honor for the world's top 5%-10% elite traders

Criteria:

Pass the Synergy Trader initial challenge

Pass the Synergy Trader Verification

KYC verification

Risk control is stable and meets institutional requirements.

Privileges:

Obtained the "Synergy Trader" certificate

Join Synergy Traders Club

Get the right to manage an account up to $600,000

Exclusive promotion channel

Honorary Title:

Synergy Trader Verified Manager

Profit Split:

Up to80%

Hall of Fame

An honorary symbol of the top 1% elite traders worldwide.

Criteria:

Become a Synergy Trader

Demonstrated stable profitability and distributed profits for 4 consecutive times

Risk control is stable and meets institutional requirements.

Privileges:

Hall of Legends

Become an exclusive member of Synergy Trader Private Club

Enjoy VIP seats at the Global Financial Summit

Get the right to manage an account up to $600,000

Top-Tier Fund Name List

Honorary Title:

Synergy Trader in Hall of Legend

Profit Split:

Up to90%

Echelon of Mastery

Only 0.1% of traders worldwide can achieve the highest honor in the trading world.

Promotion Criteria:

Achieved stable profit in the Trading Hall of Fame and received 4 consecutive profit sharing

Trading performance meets global professional standards.

Possess market influence and play a leadership role.

Exclusive Privileges:

Echelon of Master

Become a fund manager and manage up to $3 million in funds

Invited to Serve as an Official Mentor

Joined Synergy Australia Capital Private Equity Fund

Establish Partnerships with Top Banks and Funds

Honorary Title:

Enter Hall of Legend

Trading Records Become Industry Benchmarks

Profit Split:

Up to90%

Fund Manager Program

Become a Synergy Australia Capital fund manager

Promotion Criteria:

Reach the pinnacle and make continuous profits

Managed account funds grew to $3 million

Possess fund management experience and be capable of independent operation.

Have influence in the capital markets and collaborate with global investors.

Revenue model

Fixed management fee (US$1 million per year) & profit sharing

Up to US$500 million fund size

Access global resources and become an industry leader.

Fund Manager Privileges

Obtain partnership status and establish a personal brand fund

Collaborate with top-tier capital institutions and participate in industry decision-making.

Trade across 50+ global financial markets

Become an official mentor and build a global influence.

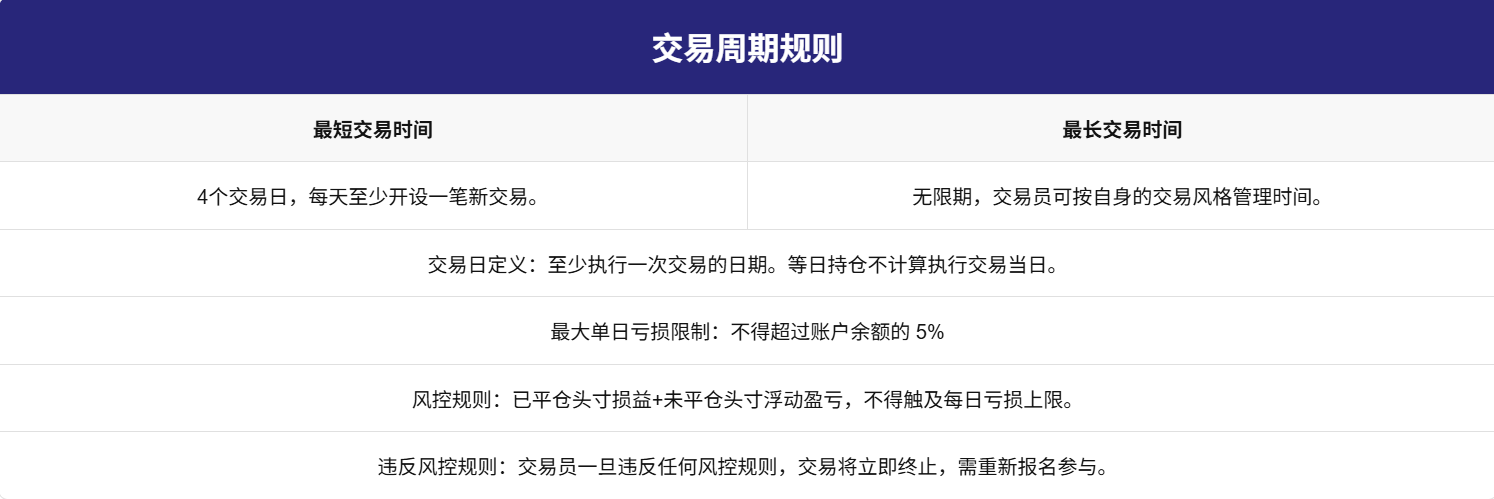

Strict and Transparent Risk Management

To ensure that traders maintain long-term stable profitability and comply with institutional capital management standards, Synergy Trader has established a strict and transparent risk management system. These rules not only protect traders from extreme market volatility but also provide investors with a clear risk control framework, ensuring the sustainability of the trading ecosystem.

Synergy Trader Simulated Account

All accounts we provide to candidates are simulated accounts funded with virtual money; all trading activities are conducted solely within the simulated environment.

Advantages:

Real Market Quotes: All trades are based on genuine market liquidity quotes, ensuring the authenticity of the trading environment.

Extremely Low Trading Costs: Offering highly competitive spreads and fees to maximize traders' profit potential.

Emotion-Free Impact: Traders' actions do not affect the market, ensuring a purely fair and unbiased trading environment.

Strict Risk Management System: Trading accounts follow rigorous risk control rules to ensure traders possess the ability to generate consistent long-term profits.

Do I need to close my positions overnight?

In the Synergy Challenge or Verification phases, you are not required to close your positions overnight. During these stages, you may hold positions overnight and even over the weekend.

However, once you become a Synergy Trader and are granted a Synergy Account, you are required to close your positions before the market closes for the weekend or if the market is closed (e.g., for rollover) for more than 2 hours. All Synergy Traders holding a Synergy Account must adhere to market hours. Each asset class and its corresponding instruments may have different trading hours that must be followed.

Standard market hours can be found on the trading platform and our Symbols website. However, due to major holidays or other events, trading hours may frequently change. All changes to standard market hours will be announced in the trading updates section, and we strongly recommend checking that page regularly.

Can I trade during news releases?

You are free to trade during all news releases once you have successfully passed the evaluation process, including the Synergy Challenge and Verification.

Here is the table of trading restrictions for Synergy Traders on specific types of reports and instruments. Only Synergy Traders with a Synergy Account are **not allowed** to execute any **new trades or close positions** within the **2-minute window before and after** the news release on the specified instruments (as shown in the table).

For clarity, executing a trade is defined as opening or closing a position (including triggering of stop-loss or take-profit orders) or market execution. You are allowed to hold positions on the restricted instruments **if they were opened more than 2 minutes before** the restricted news event. However, if your stop-loss or take-profit order is triggered within the restricted window (2 minutes before to 2 minutes after the news release), it may be considered a violation** of the Synergy Account Agreement.

Other non-target instruments can be traded normally. For example, you may trade EURGBP or AUDNZD during the US Nonfarm Payroll release, but you should not open or close positions on USDJPY or GBPUSD within the time window from 2 minutes before to 2 minutes after the release.

Our Mission

Synergy Trader selects and cultivates traders with outstanding trading abilities through a rigorous evaluation system, establishing global standards for trader assessment. Here, you bear no personal capital risk and can join the promotion program. Your trading career is no longer limited to personal accounts but advances to the commanding heights of the financial market. Whether you aim to refine your trading skills or aspire to manage billions in capital, we provide you with the most competitive resources and unlimited growth opportunities, helping you embark on the path to becoming a top-tier fund manager!

Synergy Trader

Synergy Australia Capital is a professional evaluation system designed for traders worldwide. Its purpose is to identify consistently profitable and outstanding traders through rigorous trading assessments, and to provide them with funding and development opportunities. Students will trade using simulated accounts, with evaluation criteria that closely mimic real market conditions.

John Glenndian

Head of Trading Strategies

Branden Brussa

Risk Management Specialist

Mike Ton

Quantitative Analyst

Partnerships

Synergy Trader is incubated by Synergy Australia Capital. Headquartered in Australia, it holds an AFSL license and operates through an SPC (Cayman) fund structure to offer financial derivatives funds. Its diversified financial solutions include AI quantitative trading, IPO & Pre-IPO investments, and real estate funds. With a forward-looking strategy, intelligent risk control, and global allocation, Synergy aims to help investors achieve steady growth and is committed to becoming a world-class fund management company.